#IPHI AFTER MARKET PRO#

Meanwhile, about a year later, the iPhone 13 Pro is sold for $899 on Amazon. The new generation arrives at the same price as the previous one in the colors space black, silver, gold, and deep purple. Learn about the similarities and differences between the smartphones in the comparison lines below. In addition, it had a reinforced technical sheet, represented mainly by the A16 Bionic processor. The device received a visual upgrade, with an interactive notch and an always-on screen. Apple’s launch has a price starting at $999.

Thank you for reading.The iPhone 14 Pro is the successor to the iPhone 13 Pro, suitable for those seeking a cell phone with cutting-edge features. Simply Wall St has no position in any stocks mentioned. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. We aim to bring you long-term focused analysis driven by fundamental data.

It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Alternatively, email article by Simply Wall St is general in nature. Love or hate this article? Concerned about the content? Get in touch with us directly.

#IPHI AFTER MARKET FREE#

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Inphi’s board and the CEO’s back ground.Valuation: What is IPHI worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether IPHI is currently mispriced by the market.I’ve also compiled a list of relevant aspects you should look at: For a more comprehensive look at IPHI, take a look at IPHI’s company page on Simply Wall St. There are key fundamentals of IPHI which are not covered in this article, but I must stress again that this is merely a basic overview. A higher level of debt requires more stringent capital management which increases the risk around investing in the loss-making company. Generally, the rule of thumb is debt shouldn’t exceed 40% of your equity, and IPHI has considerably exceeded this.

IPHI currently has a debt-to-equity ratio of 137%. Underlying developments driving IPHI’s growth isn’t the focus of this broad overview, however, bear in mind that typically a high growth rate is not out of the ordinary, particularly when a company is in a period of investment.īefore I wrap up, there’s one issue worth mentioning. NYSE:IPHI Past and Future Earnings June 15th 2020 What rate will IPHI have to grow year-on-year in order to breakeven on this date? Using a line of best fit, I calculated an average annual growth rate of 111%, which is rather optimistic! If this rate turns out to be too aggressive, IPHI may become profitable much later than analysts predict.

Therefore, IPHI is expected to breakeven roughly 2 years from now. They expect the company to post a final loss in 2021, before turning a profit of US$41m in 2022. The most pressing concern for investors is IPHI’s path to profitability – when will it breakeven? In this article, I will touch on the expectations for IPHI’s growth and when analysts expect the company to become profitable.Ĭonsensus from the 13 Semiconductor analysts is IPHI is on the verge of breakeven.

#IPHI AFTER MARKET FULL#

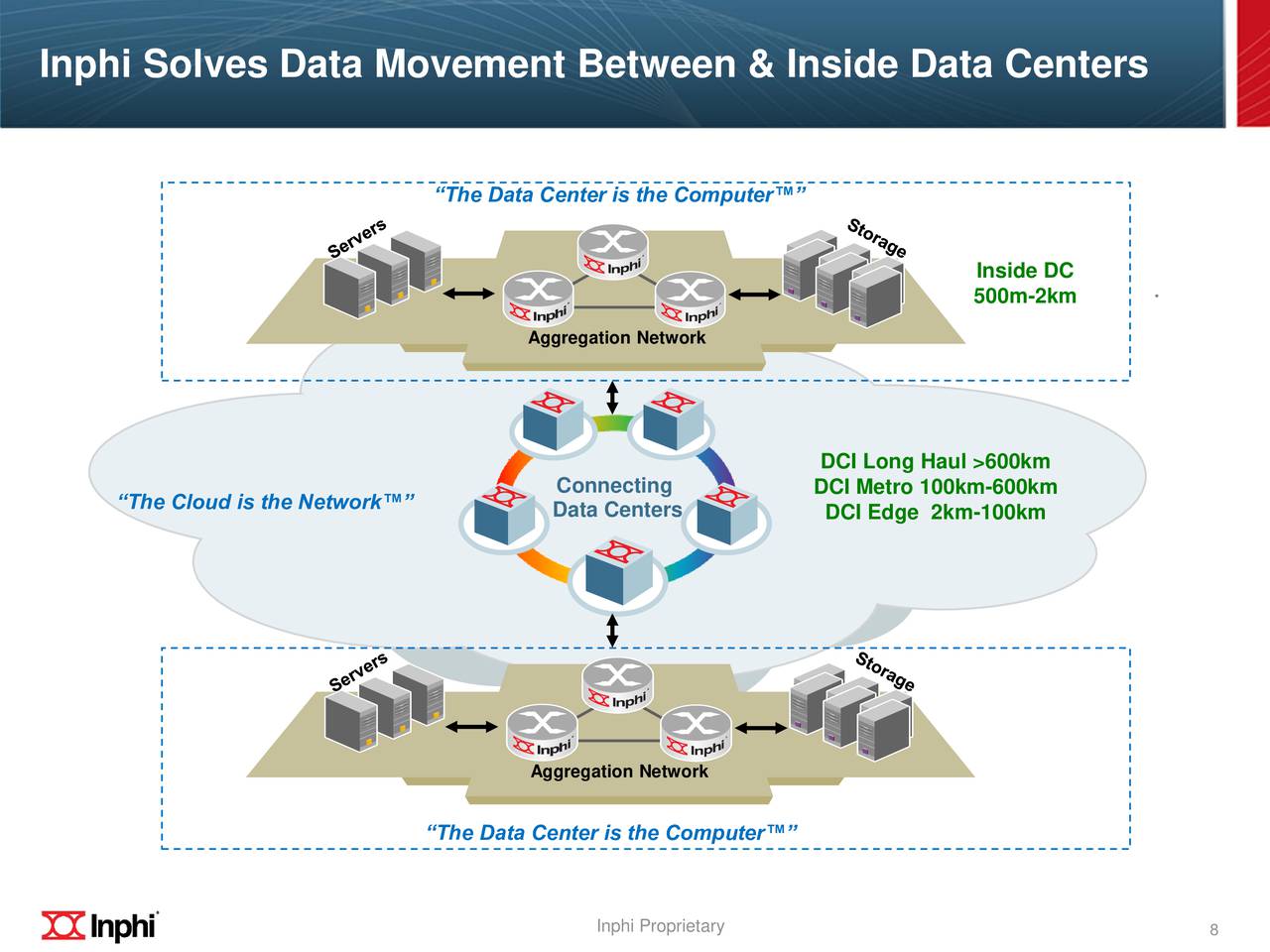

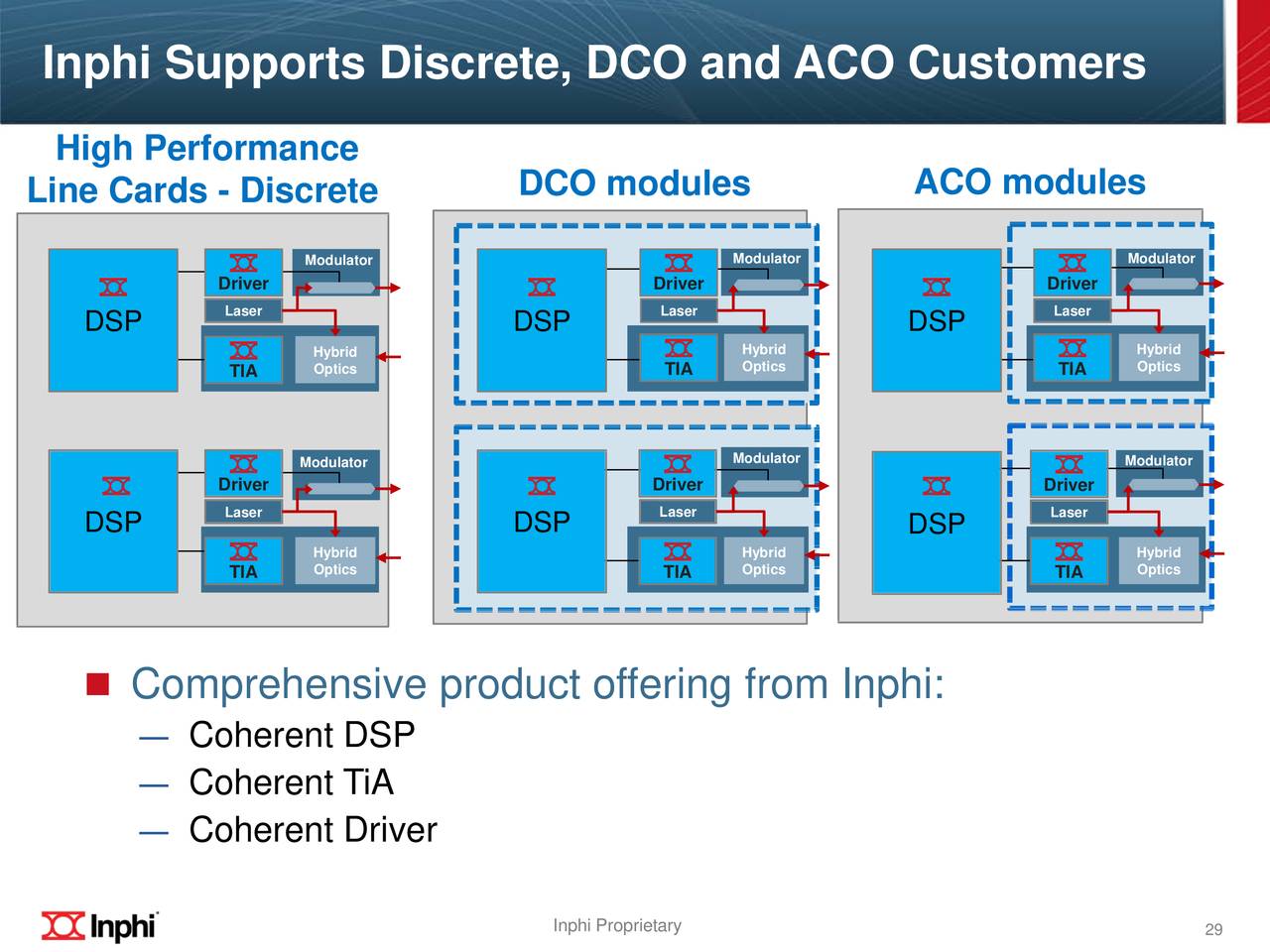

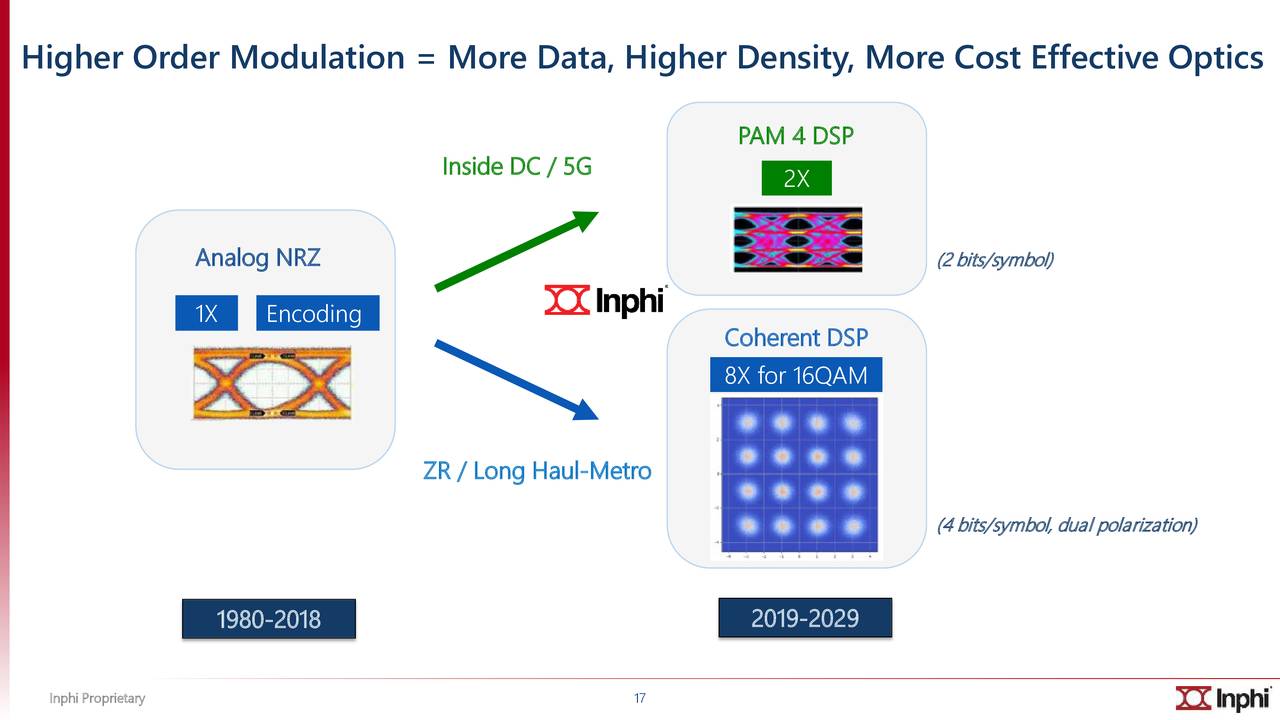

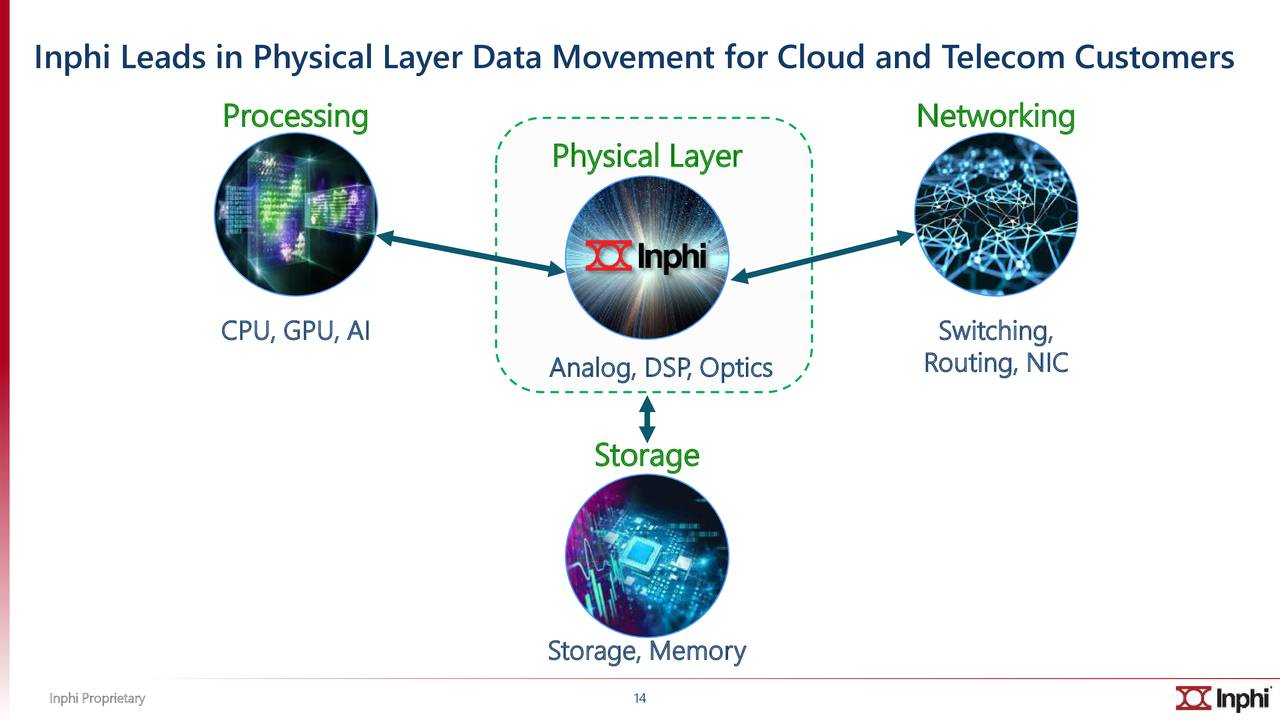

The US$5.3b market-cap company’s loss lessens since it announced a -US$72.9m bottom-line in the full financial year, compared to the latest trailing-twelve-month loss of -US$70.5m, as it approaches breakeven. Inphi Corporation's ( NYSE:IPHI): Inphi Corporation provides high-speed analog and mixed signal semiconductor solutions for the communications, datacenter, and computing markets worldwide.

0 kommentar(er)

0 kommentar(er)